Cronos Ecosystem Spotlight: Ferro Protocol

We are kicking off the Cronos Ecosystem Spotlight series — a series of interview articles covering projects that are building on Cronos…

We are kicking off the Cronos Ecosystem Spotlight series — a series of interview articles covering projects that are building on Cronos Chain.

Today, the spotlight is on Ferro Protocol, a StableSwap AMM that brings a much more efficient way for users to exchange stablecoins and other highly correlated assets by creating efficient pools with a stable curve.

1. Can you share with us the origin story of your project?

For sure!

First, a big thank you for giving us the opportunity to share more about Ferro.

Our team consists of heavy users of the Cronos chain. We love the low fees, fast throughput and the various integration the chain has with Crypto.com’s suite of products.

The number of DeFi projects has been gradually growing in the Cronos ecosystem. However, our team felt that Cronos lacked a dominant StableSwap with deep liquidity. This frustration was further exacerbated when we were making large volumes of stablecoin swaps.

As DeFi continues to attract users and liquidity, we realised that there was a big need for a cheaper and more efficient way to swap stablecoins and pegged assets.

Our team thus decided to build Ferro Protocol to solve this problem.

2. What is your value proposition to end-users and how do you differentiate?

When a user performs a stablecoin swap using traditional Automated Market Maker (AMM) DEXs, they will incur costs such as swap fees and slippage. The swap fee for traditional AMM is around 0.3% and slippage tends to go up as the swap amount increases.

In comparison, Ferro charges a more competitive swap fee of 0.04% and ensures that users get a lower slippage.

We are able to achieve this because:

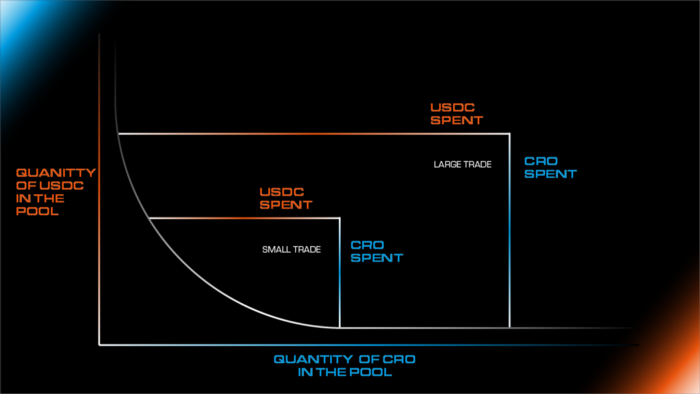

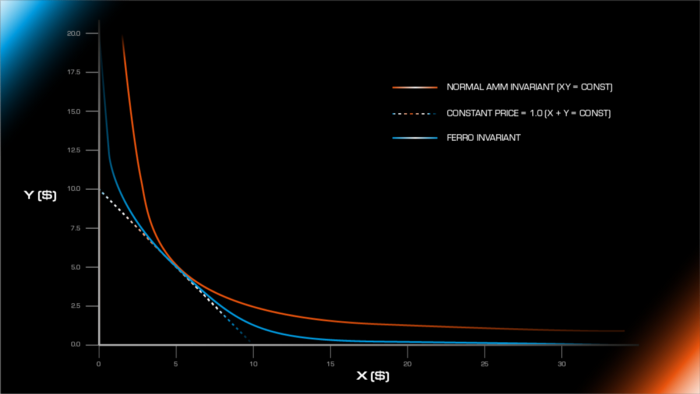

Most traditional AMMs utilize a x*y = k invariant (constant-product), where exchange rates are meant to fluctuate according to supply and demand. Such a mechanism ensures that the Liquidity Pool does not drain out even when there are large order amounts. However, this results in higher slippage when the pool becomes more unbalanced.

To solve this issue, Ferro takes a hybrid approach with a Stableswap curve that combines both Constant Product and Constant Sum models. Switching between x*y = k invariant (constant-product) when the pool is imbalanced and x+y=k invariant (constant-sum) when the pool is balanced.

This smoothns out the curve for stablecoins and pegged value assets, allowing the users to get the lowest slippage and maximize capital efficiency.

Liquidity Pools on Ferro

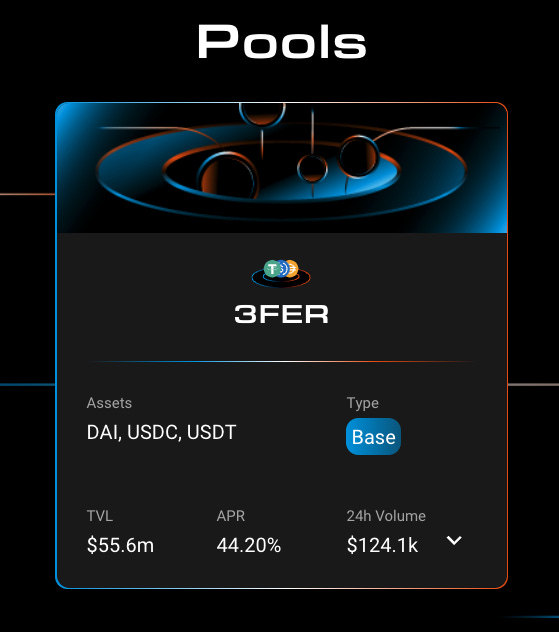

There are two types of pools on Ferro: Base Pool and Meta Pool.

As an example, the 3FER pool is a Base Pool on Ferro that is made up of USDT, USDC, and DAI.

Leveraging on Base Pool, Ferro is able to add 1 or more tokens to it, turning it into a Meta Pool. For example: pairing Ferro’s 3FER with TUSD. The Meta Pool will consist of TUSD and 3FER LP tokens. Utilising such a construct, liquidity providers of 3FER who are not providing liquidity in the TUSD Meta Pool are shielded from systemic risks within the pool.

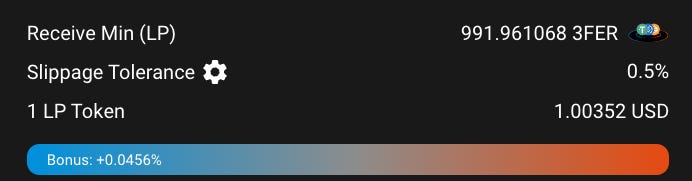

In addition, our liquidity pools in Ferro carries a mechanism to incentivise/disincentivise users to LP a particular token, in order to balance the proportion of tokens in the pool.

For example: Users depositing underweighted token (Vs. other token in the pool) will receive a deposit bonus and vice versa.

These enhancements with Ferro allows for a more efficient way to access stablecoins & other highly correlated assets with lower fees & slippage. Ferro’s composable pools will provide additional utilities to different types of assets.

3. Can you share with us more about the founding team and their past experiences?

We are a team of 6 crypto natives — 3 of us cover product development, 2 code ninjas, and 1 all-star designer. Our team has vast prior experiences working across FAANG and within the Crypto space with strong backgrounds across project design, software engineering, and marketing.

We’ve been watching the growth of the Cronos ecosystem since day one and we took a leap of faith to join the #CROfam and built out Ferro over the past few months! We hope to bring in our expertise from our diverse backgrounds and build the best product experience for our users.

4. Why did you choose to build on Cronos?

We are heavy users of Cronos and see ourselves as part of the #CROfam. We thus wanted to build a product on Cronos and help the chain to expand its ecosystem.

On the technical side, Cronos being EVM-compatible streamlines our development as our developers are heavily experienced in Solidity.

Furthermore, the low-gas fees, high throughput for scalability, and interoperability between Ethereum and Cosmos are all major value propositions for us.

The chain has been increasing in popularity with Crypto.com providing strong support for Cronos. We see the acceleration in technology and user base growth which really excites us as we continue to build on Cronos.

5. What have been the outcomes of your integration with Cronos in terms of key performance metrics?

Being part of the Cronos Labs incubation program, we have received tremendous support from the #CROfam in the Cronos ecosystem.

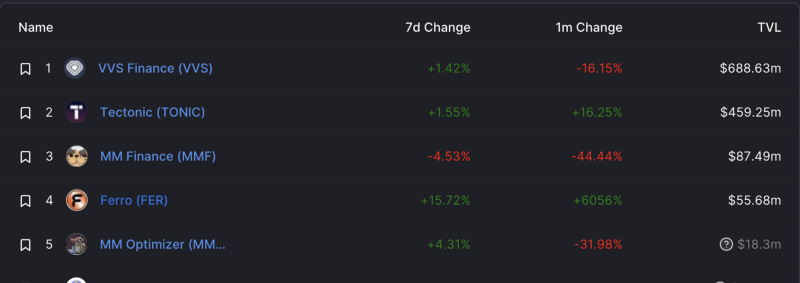

Since our beta launch, we’ve been getting massive audience following on what Cronos ecosystem offers. We have also partnered with VVS Finance, the leading DEX within the Cronos ecosystem, to launch our $FER token via their IGO. Within 1 month of our official launch, we have surpassed over $50 Million in TVL, bringing us within the top 5 projects on Cronos.

Recently, Ferro has integrated with the Crypto.com Defi wallet to provide an end-to-end seamless experience for our users. It has been a great opportunity for Ferro to gain publicity and further expand our user base.

We certainly look forward to having more partnerships with other Cronos projects in the future!

6. Where can a user new to Ferro learn more about it?

We have our how-to guides on our documentation with videos hosted on our YouTube channel.

And if you have questions and feedback, we absolutely love to hear them. You can get onto our telegram or discord.

About Cronos

Cronos (cronos.org) is the first EVM-compatible Layer 1 blockchain network built on the Cosmos SDK, supported by Crypto.com, Crypto.org and more than 300+ app developers and partners. Cronos is building an open ecosystem where developers can create their own DeFi and GameFi applications, targeting a base of 50+ million users globally. Earlier this year, Cronos Labs launched a $100M Accelerator program to help developers build new projects and the future of Web3 within the Cronos ecosystem.

When developers build on Cronos, they can leverage all Ethereum developer tools (i.e. Solidity, Truffle, Hardhat, OpenZeppelin, Web3.js, ethers.js, ChainSafe Gaming SDK); leading crypto wallets (i.e. MetaMask, Crypto.com Defi Wallet, Trust Wallet); wrapped versions of the world’s top 50 cryptocurrencies; Cronos Play, a suite of developer tools for Unity, C++ and Unreal engine; and inter-blockchain communication (IBC) cross-chain connectivity to Cosmos chains; and as well as a rich ecosystem of composable DeFi and GameFi dApps.

Cronos is supported by Cronos Labs, the ecosystem grant fund, Web3 start-up accelerator, and incubator of Cronos chain.